Our Mission

To bridge between all that there is and all that can be.

About Us

Menomadin Group is a visionary organization, part of a mission-driven ecosystem of businesses and philanthropies pursuing a shared purpose. Established in 2019 by businessman and philanthropist Haim Taib, the Menomadin Group is dedicated to impactful endeavors that generate transformative and reality-altering value on a global scale.

Our financial team works closely with industry specialists to secure funding for transformative initiatives, all the while ensuring alignment with SDG objectives and adherence to ESG standards. Through risk mitigation and the provision of comprehensive financial planning, we empower our subsidiaries to confidently achieve meaningful impact, and bring about lasting change.

Our investment philosophy

At Menomadin Group, we believe that strategic investments can catalyze positive change and drive sustainable growth. We approach investment decisions with a forward-looking mindset, seeking opportunities that align with our vision of fostering socio-economic development, empowering communities, and promoting innovation.

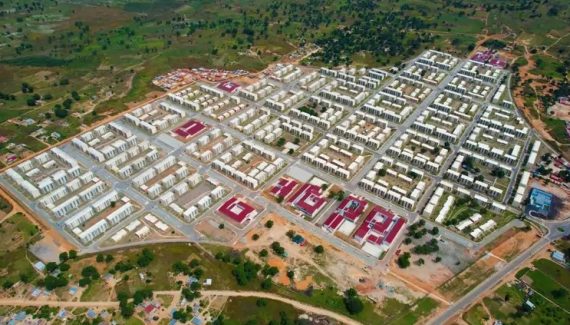

Real Estate: Our investments are directed towards ventures that align with sustainable ESG standards and have the potential to bring about transformative urban development, enhance infrastructure, and promote community well-being.

Capital Markets: In the ever-evolving world of capital markets, we strategically invest in various financial instruments, aiming to optimize returns while prioritizing effective risk management.

Finances: Our proficiency in financial investments enables us to assist our subsidiaries and partners in achieving both financial stability and sustainable growth.

Startups: We invest in promising startups with the aim of nurturing groundbreaking ideas that have the potential to drive transformative societal change.

Our balanced and diversified portfolio is designed to establish a solid financial foundation for our subsidiaries, empowering them to pursue ambitious initiatives with confidence and resilience.

Our Ecosystem

The Mitrelli Group

Mitrelli is an international group of specialized companies dedicated to turnkey mega projects that enhance quality of life and economic growth in sub-Saharan Africa. With 10 subsidiaries and associated companies and over 2,500 employees, the group initiates, designs and executes sustainable solutions in fields ranging from education and employability, to healthcare, food security, clean water and energy, urbanization and affordable housing, digital transformation, environmental protection, as well as culture.

With a deep commitment to quality, safety, and environmental sustainability, the Mitrelli Group is a forerunner in achieving the UN Sustainable Development Goals (SDGs), seamlessly incorporating socially beneficial initiatives into its thriving business ventures. The group’s multi-disciplinary team of experts collaborates closely with governments, the business sector, and local communities to address local needs, ultimately generating a positive and lasting impact on societies and nations.

Learn more about the Mitrelli Group >

The Menomadin Foundation

The Menomadin Foundation is an international impact fund, leading a charge in generating social, environmental, and economic impact in Israel, Africa and worldwide. Through a model that integrates strategic philanthropy, impact investments, and cross-sector collaborations, the foundation aims to identify the roots of complex problems and design creative, holistic solutions that achieve deep and systemic change wherever it operates.

Armed with a business mindset and a research-based approach, the foundation employs leading impact measurement and management tools and practices, quantifying progress towards transformative impact.

The Menomadin Foundation operates in Angola through the non-profit foundation Fundação Arte e Cultura, promoting social and environmental initiatives, as well as local culture and art.

Learn more about the Menomadin Foundation >

Join Us in Shaping a Better Future

Menomadin Group invites you to be part of our journey towards a more prosperous, sustainable, and inclusive world. Together, we can make a profound difference and drive positive change that empowers communities and uplifts humanity. Contact us >

Our Vision

It is not your call to complete the task of perfecting the world, but neither are you free to desist from it.

We're here

to do our part.

Our Values

-

Powered by Vision, Leading with Conviction

The human potential is limitless. Equipped with a crystallized approach to impact, Menomadin strives to unveil the world's brilliance, leading by example and achieving excellence. -

Nurture Partnerships, Advance with Diversity

A tightly-knit network is stronger than the sum of its parts. Menomadin harnesses the diversity of its passionate community, recognizing the collective gain of adding seats to the table. -

Seek to Empower, Orchestrate with Empathy

Communities are their people are their communities. Menomadin is committed to the constant achievement of evident milestones on the journey to empower resilient societies, thoughtfully leading extraordinary projects with substantial outcomes. -

Systematically Rigorous, Armed with Creativity

Scalable impact can only be accomplished by adhering to a methodological theory of change. Coupled with its effective conduct, Menomadin is ever prepared to initiate human-centered resourceful solutions, tailor-made for the specific needs of the hour.

Media Highlights

SDG-Driven Businesses: Aligning Profits with Purpose

The UN's Sustainable Development Goals (SDGs) can and should serve as a compass for businesses to promote economic growth that benefits our collective future.

Development that invests in Africa’s stability

September 2023

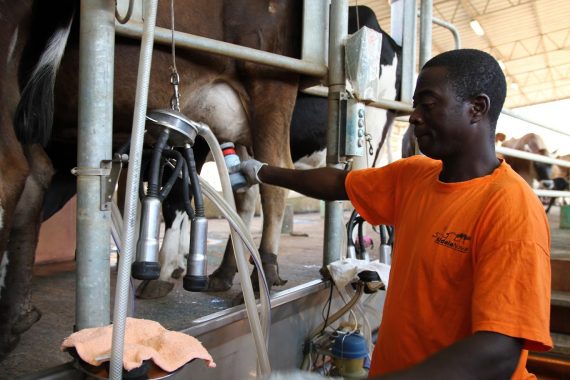

Creating Food Security in Angola

September 2021

Israeli group to bring in children for surgery

November 2021

Better quality of life through water systems

Green Innovation